A Critical Step Towards Fighting Critical Illness

Let’s face it – we live in a dangerous world. From motor vehicle accidents to contractible illnesses, it’s a miracle that we are willing to leave our homes at all.

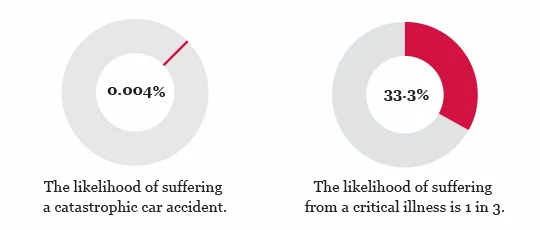

And yet we do. We do because we realize that if we worried about every single risk we would be risking even more by not allowing ourselves to live our lives to their fullest potential. While we can push some of the smaller risks out of our minds, there are some larger ones which should not be ignored – especially when there is a practical solution for mitigating them. Unlike the chance of a house fire or catastrophic car crash, which are 1 in 1165* and 1 in 4830** respectively, the chance of suffering from a critical illness is 1 in 4 for men and 1 in 5 for women***. This is a large risk, but one that can be bridged by critical illness insurance.

Critical illness insurance pays out a lump sum benefit upon diagnosis, and survival, of conditions covered by your policy. Conditions range from cancer, heart attack, and stroke to comas and severe burns with most conditions requiring surviving 30 days beyond the original diagnosis. Depending on the illness, the costs of replacing lost income due to inability to work, and the costs of covering current expenses and health recovery expenses that are not covered by provincial health care plans will vary. Your insurance advisor can help you determine your capital needs depending on your specific situation.

A critical illness policy can be used as a form of savings plan. Most policies provide a return of premium if your policy expires or is canceled. This means that you, the policyholder, could be entitled to a full or partial refund of the premiums you have already paid. Simply put, you will either be receiving a cheque in the form of a critical illness benefit (should you become sick) or a cheque for a health benefit (should you remain healthy).

Critical illness is a risk that comes with being human. Critical illness insurance is available to provide financial security and peace of mind.

References

*Sources: Statistics Canada, Census of Population, 2016 – 2016 Census Topic: Type of dwelling (statcan.gc.ca) - Date modified: 2022-02-08 and Table 35-10-0192-01 Incident-based fire statistics, by type of fire incident and type of structure (statcan.gc.ca) - 2022-03-28

**Sources: Government of Canada website – Canadian Motor Vehicle Traffic Collision Statistics: 2020 (canada.ca) - Date modified: 2022-02-01

***Sources: Manulife InsureRight – What is your risk? - Critical illness probability based on combined incidence rates for Cancer (“New cases for ICD-03 primary sites of cancer: 2002-2007”) and the Heart and Stroke Foundation of Canada (“The Growing Burden of Heart Disease and Stroke in Canada, 2003”).